The Malaysian ringgit plunged to its lowest level in over three years on Thursday amid the brutal sell-off across emerging market assets, and strategists say the pain may not be over for the currency.

The ringgit has declined 10 percent against the U.S. dollar since late-May on concerns over a potential capital flight from the country's government bond market in favor of rising U.S. Treasury yields.

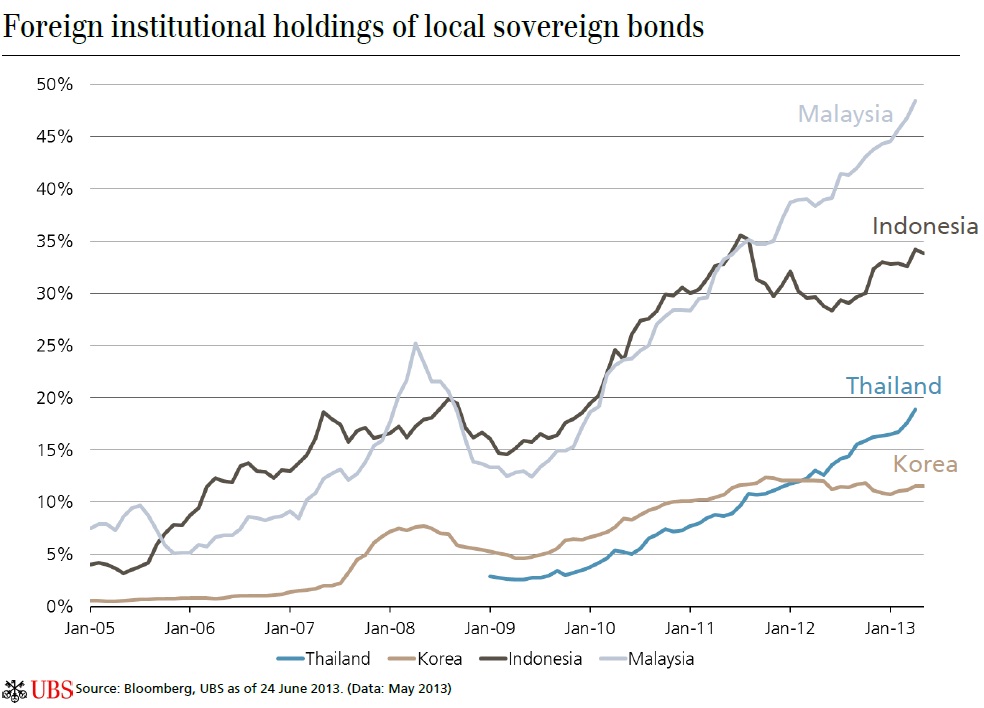

As illustrated in the chart, foreigners hold almost 50 percent of Malaysia's government bonds, an exceptionally high level compared with other emerging markets in the region, placing the currency in a precarious position.

Malaysia's deteriorating economic fundamentals - seen in surging levels of household debt - and the risk of a credit rating downgrade exacerbates the risk of outflows from the country's debt market, say experts.

"In Malaysia, the key risk to capital flows emanates from the large foreigners' holding of bonds. The fiscal concerns and the risk of Fitch downgrading Malaysia's rating could trigger net outflows from the bond market, hitting the currency," Santitarn Sathirathai, research analyst at Credit Suisse wrote in a recent note this week.

In July, Fitch Ratings cut the nation's credit outlook to negative from stable, citing a lack of budgetary reform and rising debt levels.

Consumer indebtedness rose to 80 percent of gross domestic product (GDP) at the end of 2012, an increase of 20 percent over the last five years, according to RBS.

"The debt servicing ratio or the proportion of household income used for interest and debt repayments is close to 44 percent. This poses a headwind to growth and high risk of financial stress if interest rates rise," Sanjay Mathur, chief Asia economist at RBS wrote in a report called 'The case for a weaker ringgit' this week.

Despite the headwinds, Barclays believes the potential capital flight risk by foreign investors from government debt has been largely priced into the ringgit moves.

"We expect further ringgit depreciation in the near term, as investors remain focused on the potential for bond outflows. Further ahead, the ringgit is likely to be supported by Malaysia's robust domestic growth, large current account surplus and manageable short-term external debt," Hamish Pepper, currency strategist at Barclays wrote in a report note.

Malaysia's current account surplus fell to 2.6 billion ringgit ($785 million) in the second quarter from 8.7 billion ringgit in the first three months, as a result of plunging exports and robust imports.

Barclays expects the currency to appreciate to 3.25 against the U.S. dollar over the next three months, from 3.31 currently.

Are you in need of cash? we lend cash to all in need of money at a low rate contact us now email:allrisefinancial@gmail.com

ReplyDeleteHello everyone..Welcome to my free masterclass strategy where i teach experience and inexperience traders the secret behind a successful trade.And how to be profitable in trading I will also teach you how to make a profit of $12,000 USD weekly and how to get back all your lost funds feel free to email me on(brucedavid004@gmail.com) or whataspp number is +22999290178

ReplyDeleteHello everyone..Welcome to my free masterclass strategy where i teach experience and inexperience traders the secret behind a successful trade.And how to be profitable in trading I will also teach you how to make a profit of $12,000 USD weekly and how to get back all your lost funds feel free to email me on(brucedavid004@gmail.com) or whataspp number is +22999290178

Very good post.

ReplyDeleteAll the ways that you suggested for find a new post was very good.

will help you more:

Online calculator to convert money and currency using today exchange rate.

convert money online

Its a great pleasure reading your post.

ReplyDeletewill help you more:

City Index pamm review

This comment has been removed by the author.

ReplyDeleteThank you for sharing really impressed with this update. And if you want a game or sports-related information you can visit this website and this is a VIP Sports TOTO site 안전놀이터. This is the most popular sports website and I hope and believe that you can get the best information and benefit. This site always updates all information.

ReplyDeleteThank you very much for Sharing amazing news for us. I'm a regular visitor this website and I'm getting very informational news. If you want to get male treatment and want Penis enlargement surgery information you must be going here 성기확대 수술. These sites always given the best information and you can get the best results from this site and you must be Benefited. Cause this site to provide male Male surgery 남성수술 Tips and tricks.

ReplyDelete